How construction & design firms can apply for Business Credit Availability Program (BCAP) in Vancouver

It is often said that the construction industry is the first to go down and the last to come back up when an economic crisis happens. In times like this, it is crucial for us to help each other so we’d like to share some information we found to get the much-needed financing.

The government of Canada announced the establishment of a Business Credit Availability Program (BCAP) on March 13th, 2020. This program aims to help Canadian businesses in getting financing needs during the COVID-19 period.

We are going to briefly talk about BCAP so we understand what it is, then we will show you how to apply for it. What this program means to us is business in good standing that are affected by the COVID-19 can borrow up to $100,000.

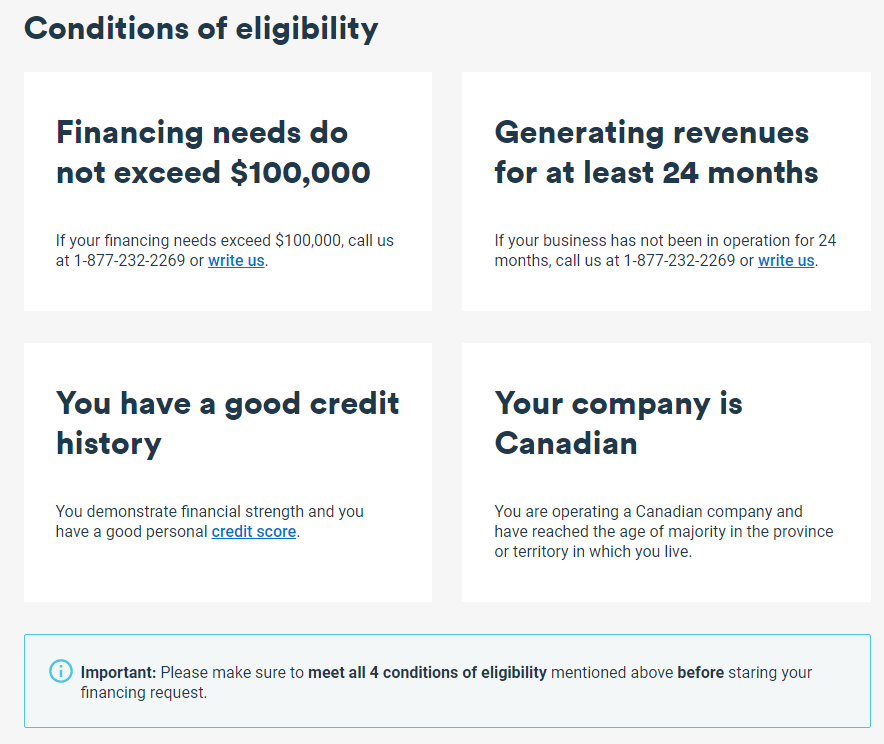

What is BCAP and how to be eligible?

The Business Credit Availability Program (BCAP) aims to support healthy businesses whose financing would be restricted by this COVID-19 outbreak situation. Export Development Canada (EDC) and the Business Development Bank of Canada (BDC) are the two big players providing $65 billion for lending. Business owners can get up to $100,000 in financing. This program is governed by a committee from the Department of Finance, EDC, BDC, and Canadian financial institutions.

Keep in mind that these loans are borrowed at an interest rate following the market rate. The BCAP program is only here to help small businesses by allowing the loan to happen.

We mentioned earlier that the BCAP is trying to support healthy businesses and the way to qualify is as follows:

- Your company is Canadian

- You have a good credit history

- Your company is generating revenues for at least 24 months.

- You are applying for financing under $100,000

How to apply for BCAP?

The canada.ca website talks about applying for BCAP through the financial institution that the businesses have pre-existing relationships with so each case can be asses before reaching to BDC or EDC.

If you would like to reach BDC or EDC, here are their contact:

Business Development Bank of Canada

1-877-232-2269

Export Development Canada

1-800-229-0575

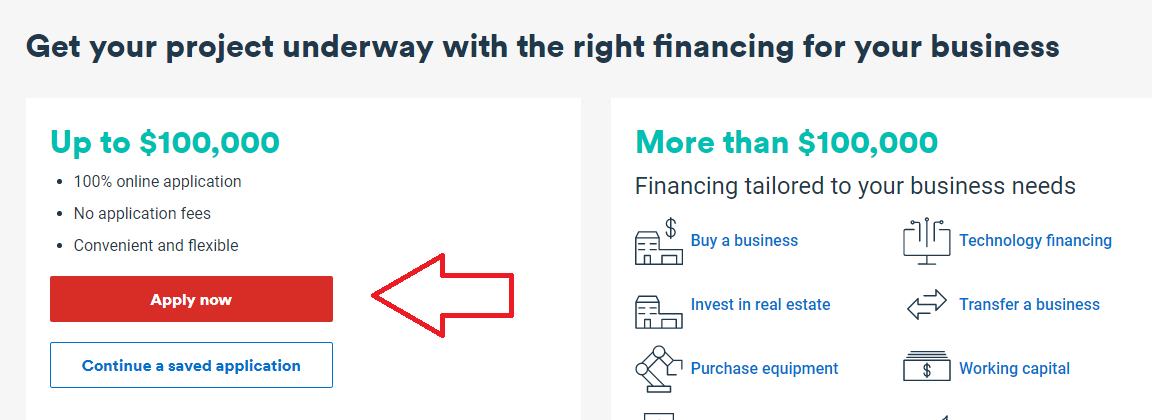

We have found an easier way to apply. By visiting the BDC official website: https://www.bdc.ca/en/financing/pages/default.aspx, you can apply online. Here’s how:

Go to BDC official website: https://www.bdc.ca/en/financing/pages/default.aspx

Business can apply up to $10,000 CAD, the key requires as follow:

- Canadian Company

- Good personal Credit Score

- Generating revenue for the past 2 years

- Applying for less than $100,000

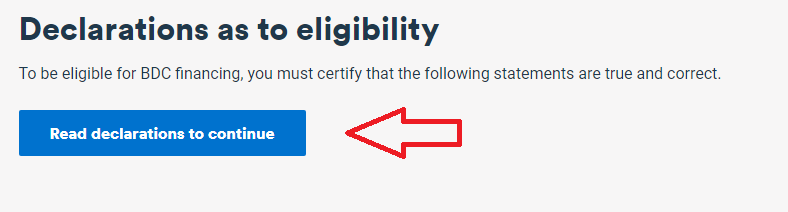

Click on the Read declarations to continue

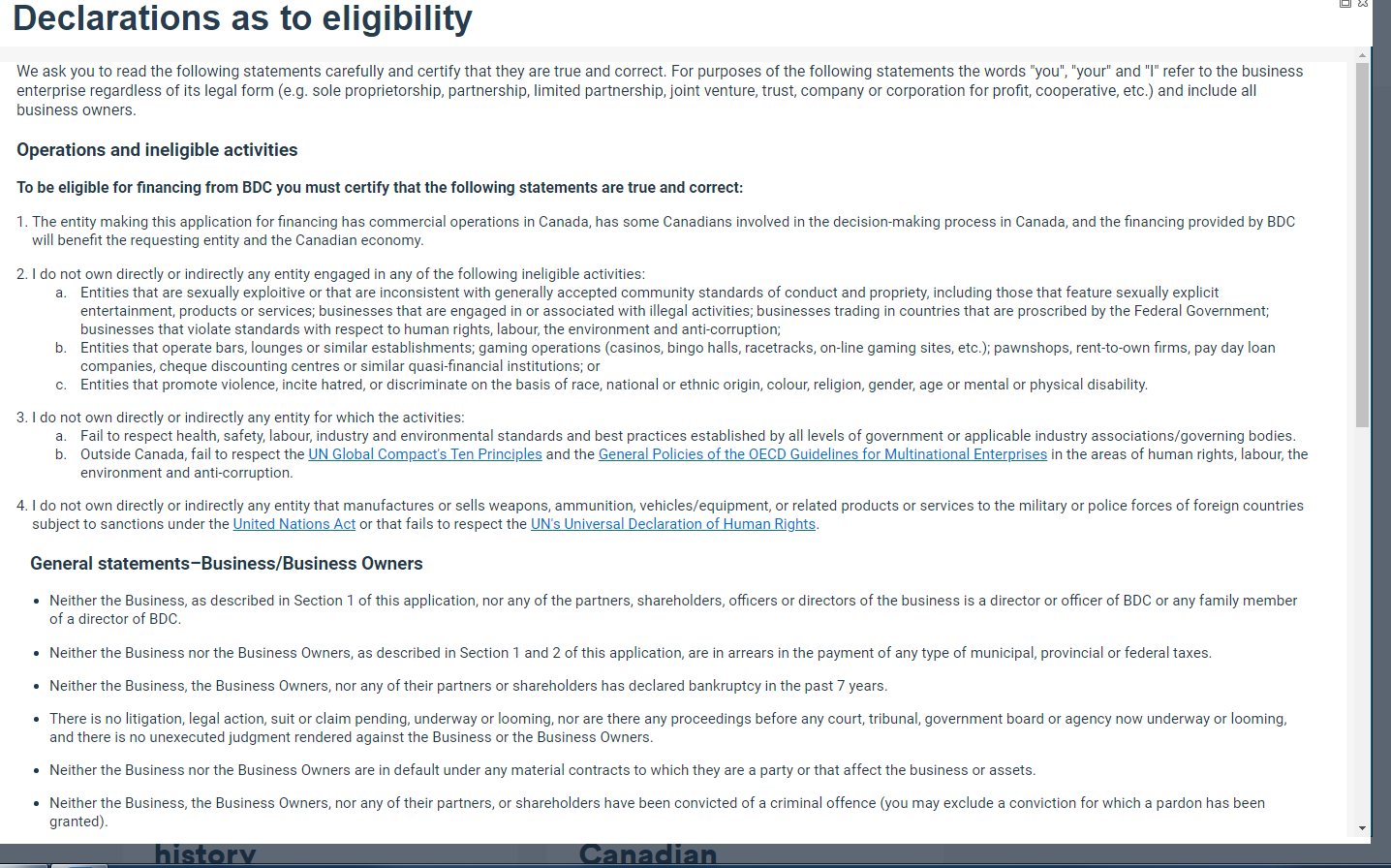

There will be a pop-up screen, in summary:

- You are operating a legal business in Canada

- Your business does not engage in prostitution, violence, human rights violations, drugs…etc.

- You do not operate bars, casinos, pawnshops, rental companies, quasi-financial companies that realise loans

- The owner, shareholders, partners have not declared bankruptcy or (being) criminally guilty in the past 7 years

- There are no current BDC employees, nor any government positions at home and abroad working in your company.

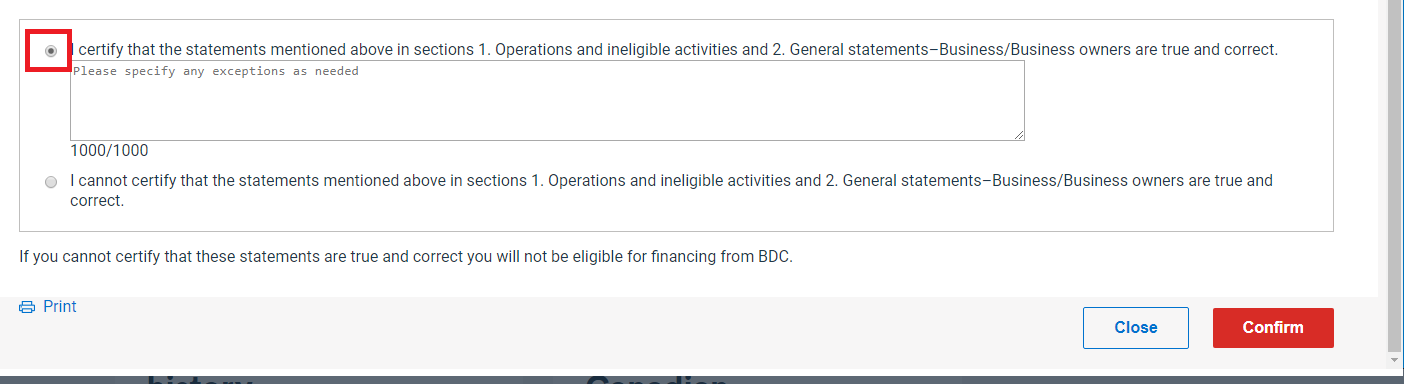

If all of the above information is correct, select “I certify …” and click on Confirm button

- For additional explanations of special circumstances, please fill in the blank space below

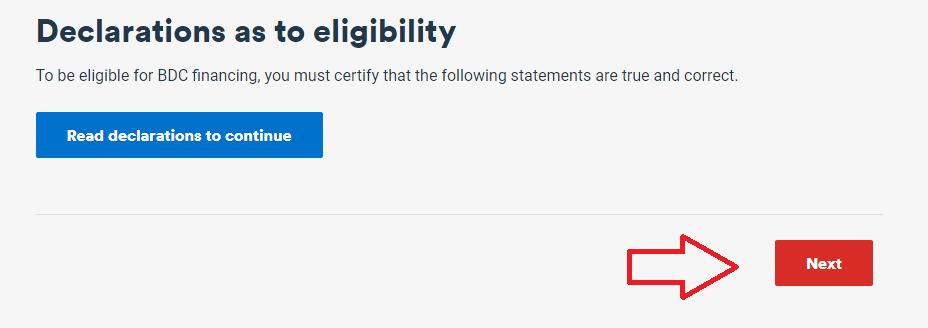

Upon the confirmation of “Read declarations to continue”, you may click Next and proceed to fill the application.

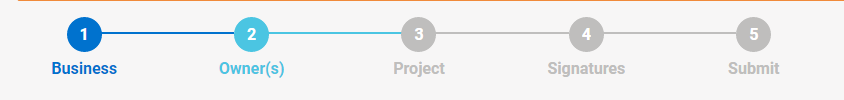

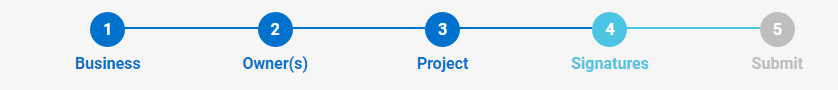

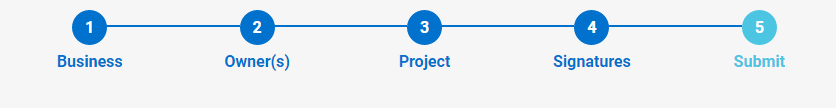

STEP 1: Business Info

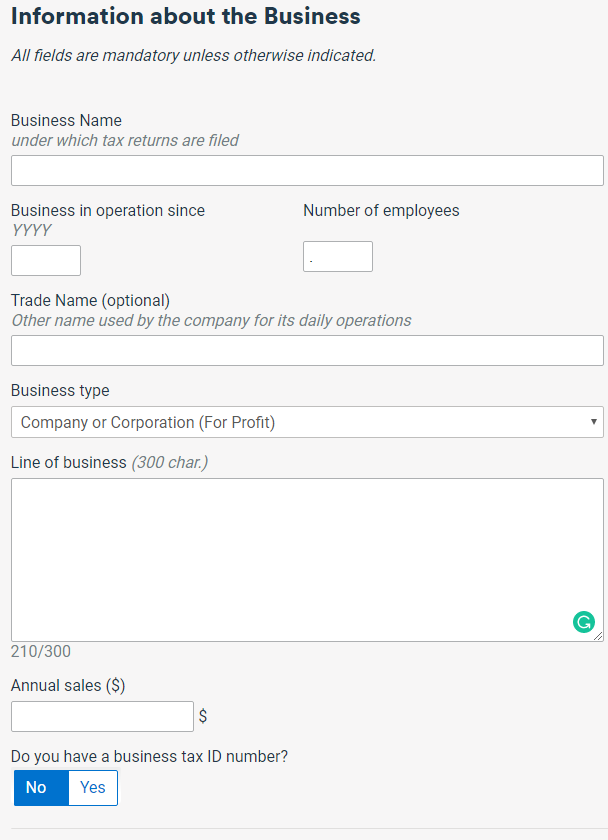

You need to fill in the fields below:

- Business (registered) name

- Operation years

- the current number of employees (before you laid off anyone due to COVID 19)

- Business (operating) name

- Business type

- Key services and product that you are offering

- Average annual revenue

- Tax ID

Business Info Confirmation

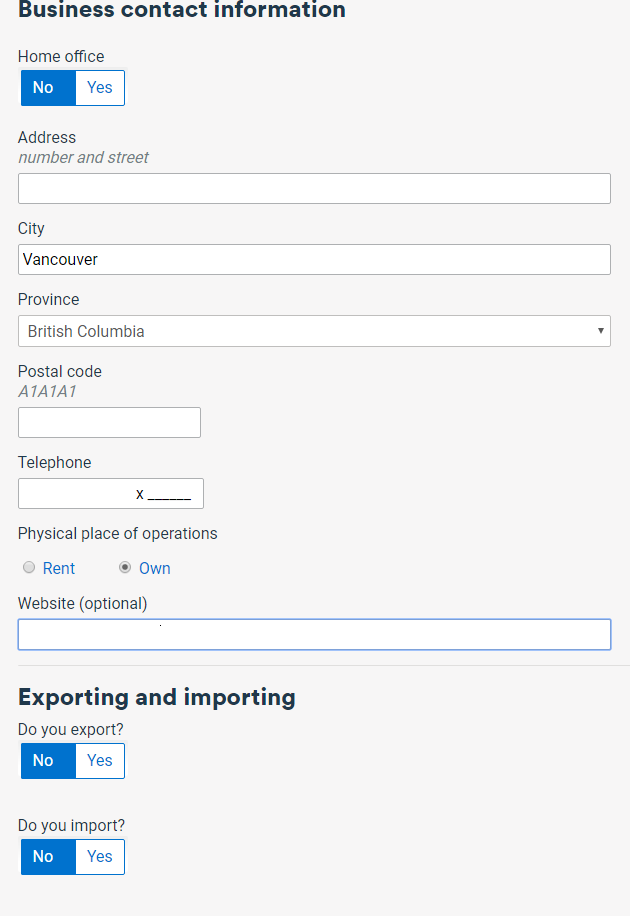

- Do you work from home (even if some of your construction & renovation employees are work from home, as long you are renting/owning a working space, you select no)

- Office address

- Phone number

- Are you renting or owning the office space

- Business Website

- do you do importing & exporting

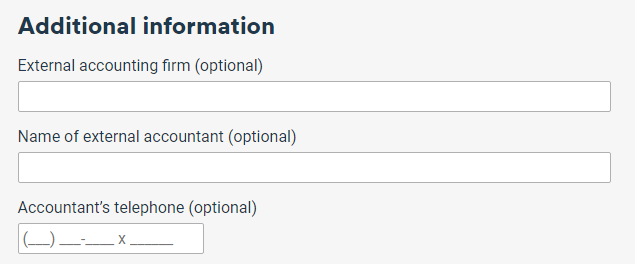

Accounting Information (if applicable)

- Accounting Firm’s business name

- Your accountant’s name

- Your accountant’s phone number

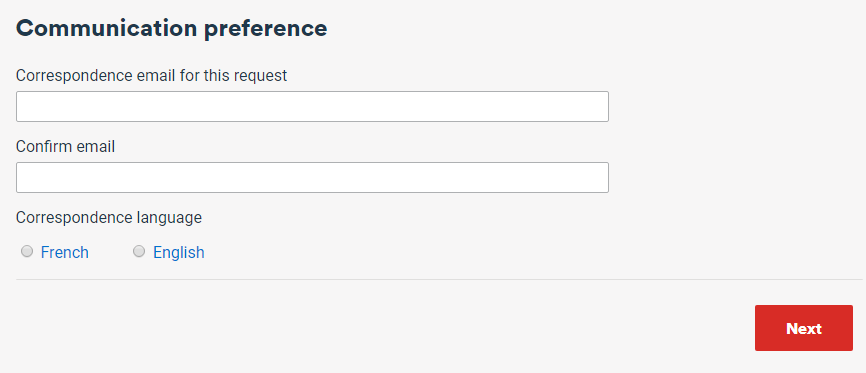

- Type in your email two times for confirmation.

- Select your language

- Click Next

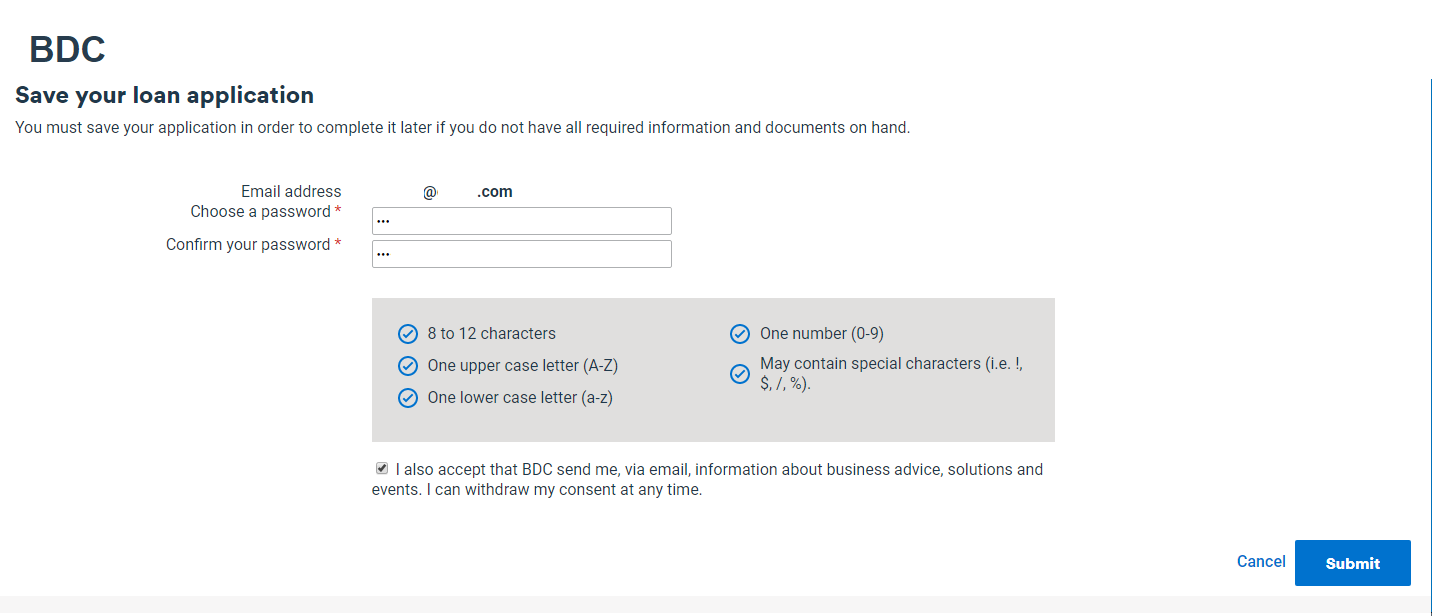

If you did not have an account with BDC before, the system will force you to sign up one.

- Click Submit

- Please DO NOT FORGET YOUR PASSWORD, otherwise, you need to call the special line to reset your password, and the process may take up to an hour to do so.

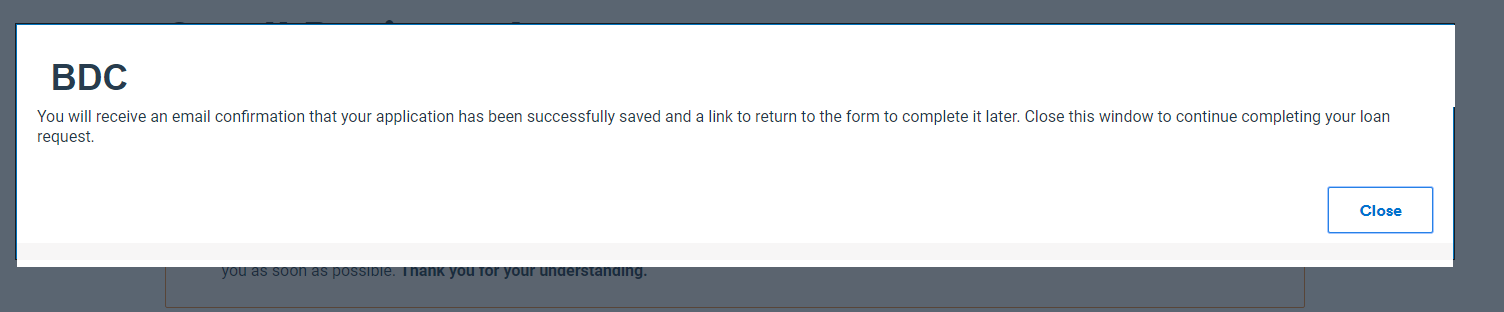

Pop-up screen to confirm your account has been registered successfully.

STEP 2: Owner’s information

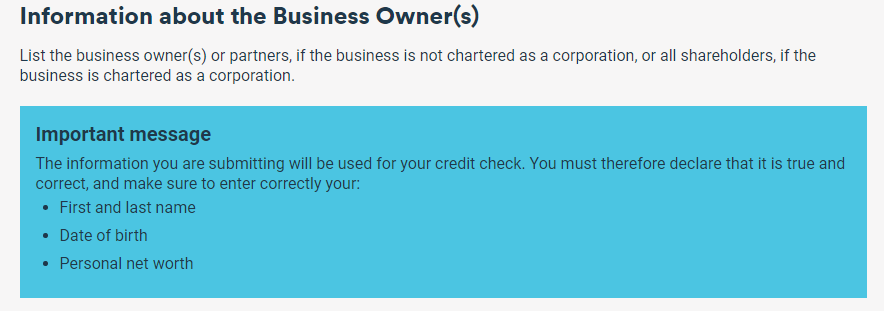

BDC will run a credit check on everyone in this application, please make sure all the information entered are correct and truthful.

Company shareholders’ information

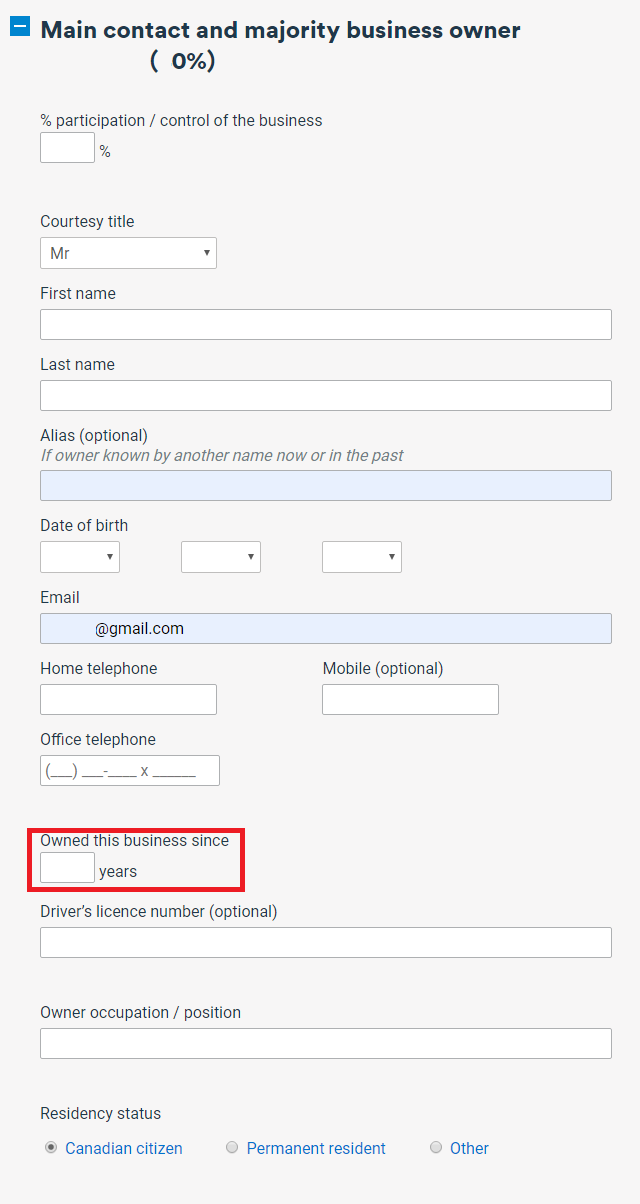

- Person #1’s shareholding percentage

- Courtesy title

- Person #1’s first and last name (make sure its the same as your driver license)

- Different name in the past (if applicable)

- Person #1’s birthday

- Person #1’s email

- The year (four digits) when you start owning the shares in this business

- Person #1’s driver license

- Person #1’s position in the company

- Person #1’s residency status

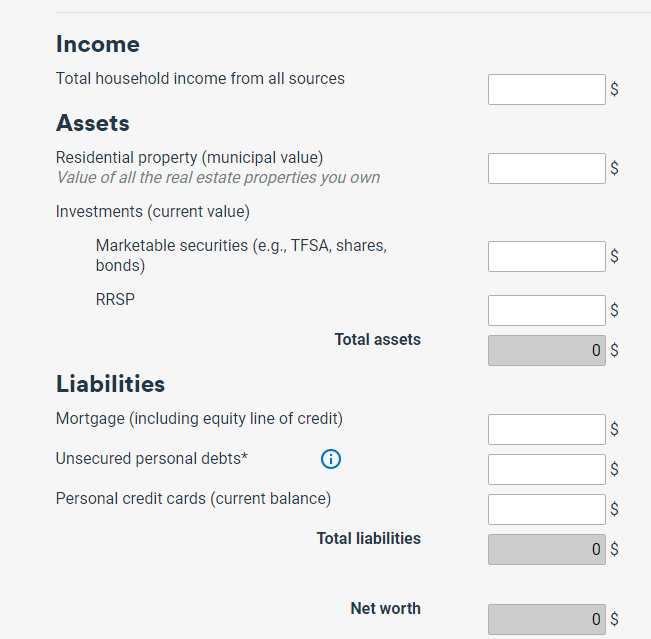

Person #1’s Income Information:

- Total household income

- Total assets

- Total Liabilities

Entering Person #2, 3,4 …’s information (if applicable)

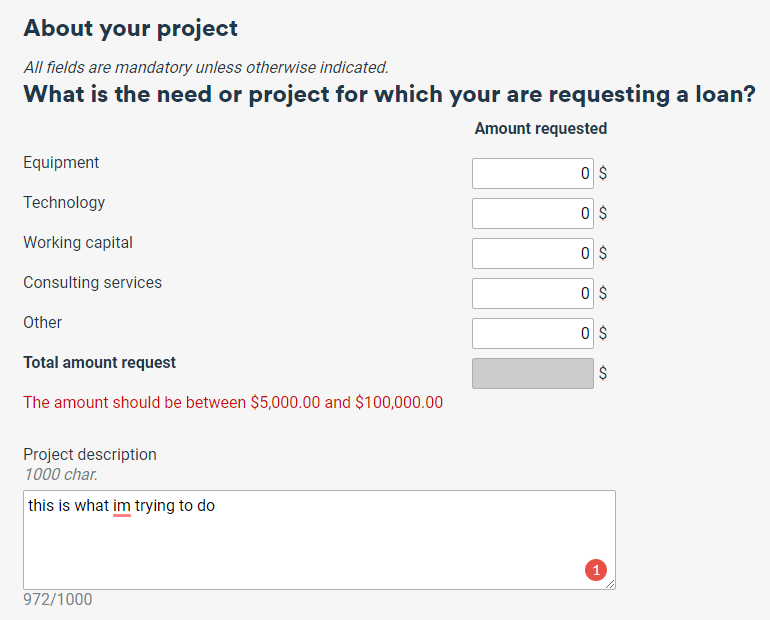

STEP 3: Why do you need the loan?

There are 5 categories you may apply the loan for:

- The total amount needs to be between $5,000 ~ $10,000

- you will need to explain:

- Why do you need the loan

- How are you going to use this loan for what

- How will the loan to help you to generate more sales, so you may PAYBACK.

- Are you referred by an employee from BDC?

- How do you hear about BDC

- Click Next

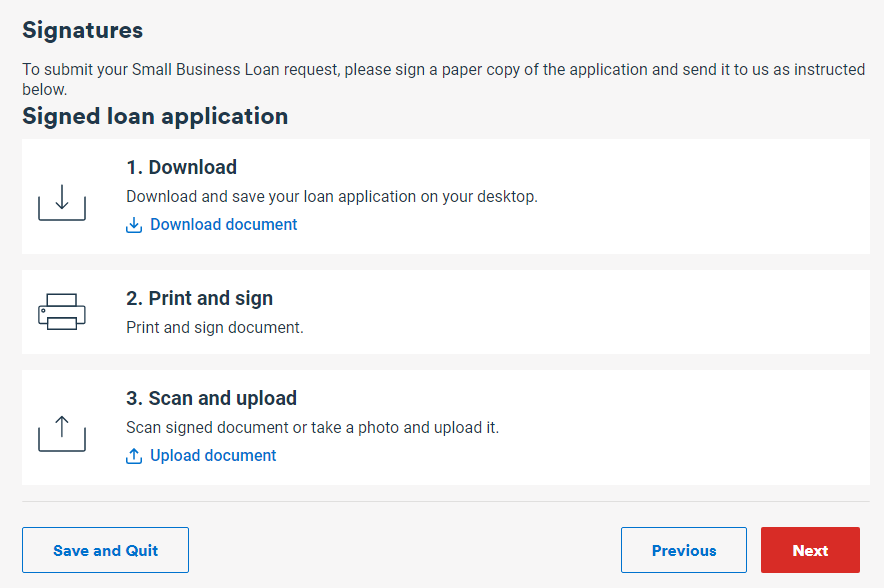

STEP 4: SIGN THE PAPER

Sign the paperwork

- Download the documents

- Print the papers (cannot do e-signature)

- Scan all pages and Upload all files

- click Next

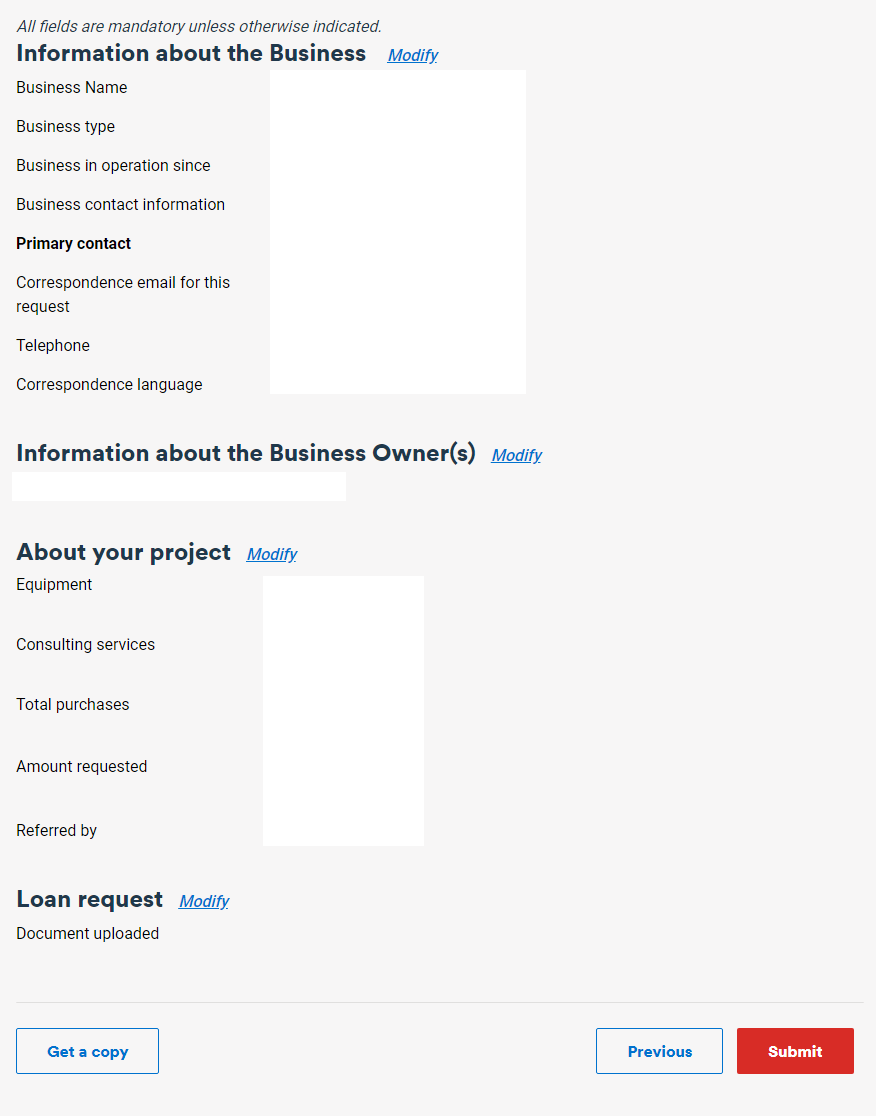

STEP 5: Submit the application

This will be the confirmation page of all the information you just filled in.

The wait time is around 1-2 weeks, then a representative from BDC will contact you, and tell you what you need to prepare for the next stage (financial statements, interim statements, detail monthly forecasts for cashflow statement, business plan..etc)